Resume Resources

Your Rich BFF’s Resume

To help you start your journey, feel free to look at Vivian’s most recent resume (prior to becoming a full-time content creator. For many, this can be used to get an idea of what types of projects and skills are marketable in the Finance and Tech industries.

Resume Action Words

We’ve compiled a list of the most effective action verbs that you can use to write your resume, regardless of what industry you are in. Utilize these buzzwords to effectively communicate your experience and value.

Additional Career Resources

AI Job Search Tools by Wonsulting

Our trusted friends at Wonsulting have been in business of professional career coaching for years. They’ve helped thousands of people from non-target schools and non-traditional backgrounds to get their dream career. Using a proprietary AI software, they have created a suite of tools to help you get ahead in your job search.

Resume & Interview Templates by Workhap

A trusted friend and colleague, Sho Dewan runs a career coaching consultancy called WorkHap. They are known for their sold-out job search program called Get Hired Academy that helps you land your dream jobs. You can also find free resources, resume templates, and interview guides on their site.

Warn Tracker: Layoff Insights from Public Records

Did you know that the US government requires big companies to provide at least 60 days of notice before a layoff? The federal WARN Act in the United States mandates that employers with 100+ employees provide at least 60 days advance written notice of a plant closing or mass layoff affecting 50 or more employees. website is intended to workers gain insight on their employee’s planned or past layoffs.

Great Side Hustles

Side Hustle Stack

If you have NO IDEA what you want to do, check out sidehustlestack.co. It’s a site where you can filter for different side hustles based on interest and time!

Meowtel

Meowtel is an at-home cat sitting service. Think dog-walking, but you don’t have to do the walking part

DScout

DScout stands for Digital Scout. This is a new digital spin on mystery shopping. You answer questions, take photos, and record videos of you interacting with brands/experiences, and get paid for feedback.

Shef

If you’re great in the kitchen - Shef is the side hustle for you. Shef allows cooks to make more servings and sell homemade food to their neighbors. You set your availability and your customers order from your menu.

AirGarage

If you love snitching - AirGarage Space Force is the side hustle for you. Think meter maid freelancing! Space Force users roam AirGarage parking lots and use their phone cameras to scan license plates and then take the appropriate action based on the status of that vehicle.

Turo

TURO, think AirBnB for your car. You can turn your vehicle into your very own AVIS rental center and lend it to other people.

Wrapify

Wrapify works with advertisers that want rolling billboards. You get paid to wrap your car with advertising and then just drive as usual, earning between $174 and $450 per month.

Task Rabbit

If you’re handy Task Rabbit is the side hustle for you. For a $25 registration fee you can create a profile and set your rate for helping people with their everyday tasks. This could span from building IKEA furniture, to organizing someone’s messy closet, to literally just standing in line.

Fiverr

Fiverr lets you market any skills you may have. You sign up as a freelancer and then set your price and offerings. This freelancing site is perfect for folks working from home trying to make a few extra bucks or stay at home parents!

Clture

It’s no secret that black culture drives a lot of what’s trendy and popular. The mission behind Clture is to let Black consumers own and get paid for their online activity. Clture allows you to connect your most used streaming accounts, helps you to create a Data License in order to own your information, and, most importantly, assists you in getting paid for the content you stream.

Lyft Bike Angels

Lyft Bike Angels tells riders which docking stations are in need of bikes or have too many, and pays out credit and cash to encourage folks to help out by dropping off or picking up their bike at one of these under or over burdened stations.

Human Microbes

Stop pooping for free! You could be flushing thousands away every year! Human Microbes pay for poo so that they can do microbiome studies or use your good gut bacteria to treat patients with intestinal or colon infections.

Rent A Friend

If you’re a social butterfly - Rentafriend.com. I know this sounds fake and maybe sketchy. But it’s legit. A lot of people just need a friend. They don’t wanna see a movie alone, need a gym buddy, or even just want a tour guide for a new city. YOU CAN BE THAT SPECIAL SOMEONE.

Modsquad

Modsquad.com, mods or moderators - are just customer service experts. You could be tasked with monitoring posts on forums or online reviews. Overseeing images, videos, or live streams. Or even chatting in-game, or play testing new games.

Play video games for money

Playtestcloud.com allows you to play video games and make some extra money. When video game companies launch new products, they need people to actually test the games to find bugs, gauge the difficulty, and provide feedback. And they’re willing to pay to ensure the games are perfect when they officially hit the market.

Brand Surveys

Get paid to take surveys and help you make some extra cash. Use Branded Surveys to give your opinion in exchange for money!

Quiz: What is your Budgeting Type?

Budgets arent about slapping your hand out of the cookie jar. They’re more like the recipe that allows you to have the biggest, fullest, most delicious jar of cookies that you can enjoy for the rest of your life. If you’re here, that ain’t going to be you. Take this quiz to discover the best budgeting method to suit your lifestyle.

Directions: For each question, choose the option that best describes your attitude towards money and budgeting. Record your answers and find out what method suits you best at the end!

Quiz

1. What is your attitude about budgets?

- I'm not afraid of a few numbers on spreadsheets or tracking apps

- I don't want to scrutinize every little detail, but i'll take a look

- I really hate tracking these little things - it doesn't work for me!

- I'm down to try it out

2. What is your attitude about budgets?

- I'm not afraid of a few numbers on spreadsheets or tracking apps

- I don't want to scrutinize every little detail, but i'll take a look

- I really hate tracking these little things - it doesn't work for me!

- I'm down to try it out

3. Which best describes your Monthly Income?

- My income varies a lot– I work in a job that is freelance, seasonal, commission-based, or heavily dependent on tips.

- My income is fixed. I know my take-home pay each month.

- My income is relatively stable, with minor variances sometimes

- I get paid twice a month on a bi-weekly basis.

4. How much control do you want over your spending?

- I want to know where every dollar is going– even for random expenses

- I want a general overview by category and spending labels, but I’m not into super complex or organized systems

- I want to set it and forget it but still meet my goals

- I just want to keep things as effortless and simple as possible

5. How do you feel about planning ahead?

- I LOVE planning ahead. I love being organized and intentional

- I like to have a general plan, but I don’t ~NEED~ to strictly follow it

- I like to go with the flow, I’m still trying to have a good time

- TBH I’m a procrastinator

Mostly A’s— Zero-Based Budgeting:

Zero-Based Budgeting is a budgeting approach where every dollar of income is allocated to specific expenses, savings, or debt payments, leaving no money unassigned.

Every dollar you take in has a specific job, even if it’s covering random expenses that you forgot about. By time time that you’ve assigned each dollar a purpose, your income minus your expenses should equal zero. Why? Because each dollar has been intentionally tracked and used for a specific function whether it’s to necessary expenses, non-negotiables, savings, and even things you forgot about.

This is great for people who have inconsistent monthly incomes because it helps them strategize how they spend their money before their next payday. You might benefit from zero-based budgeting if your work is seasonal, freelance, or heavily dependent on tips or commissions.

Mostly B's— 50/30/20 Budgeting:

This method is great if you consider yourself a procrastinator– Think of it like a college midterm essay. By splitting up the work into even parts of effort, you’ll be able to get ahead of the stress when it comes down to deadlines.

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment.

This approach provides a simple framework for managing finances, promoting a balance between essential expenses, discretionary spending, and financial goals. It offers flexibility while emphasizing the importance of saving for the future.

It is best for people who would like general guidelines to see where theyre money is going– but aren’t fans of tracking every single dollar. Following the guide in Rich AF, split up your expenses into categories and then figure where they stand in relation to necessary expenses, discretionary spending, and savings.

The key here is that your spending must be equal or less than the 80% of your income (50% necessities + 30% discretionary spending). If you’re spending more than that, you will know it’s time to re-evaluate your middle 30% for the “wants.”

Mostly C's— Reverse Budgeting:

Reverse budgeting flips the traditional budgeting approach. Instead of allocating money to specific categories and tracking spending, you start by committing a chunk of cash for savings and investment goals. You’re then free to spend the remaining money however you’d like while also reaching your financial goals.

This method prioritizes savings and financial objectives first, encouraging individuals to live within their means after securing their financial future. It’s a great option for those who have a tendency to overspend or take money out of their savings accounts. It’s one way to easily “set it and forget it” and get into a budgeting groove

Mostly D's— Half Paycheck Budgeting:

Half-paycheck budgeting is a strategy where you budget and pay bills every time you receive a paycheck twice a month. You essentially split the cost of your bills into two lump sum payments. Your first paycheck of the month covers one half of your expenses, and the second paycheck covers the other half.

This method is great if you consider yourself a procrastinator– Think of it like a college midterm essay. By splitting up the work into even parts of effort, you’ll be able to get ahead of the stress when it comes down to deadlines.

How to Calculate How Much You Really Make

Reflect:

Although it sounds like a simple question, I never had a straight forward answer. I knew what my annual salary was, but what about my monthly salary? What about hourly?

Even then, there are factors as “pre-tax” or stock options and RSUs. It can vary so much. While everyone’s financials are different, there are certain things you can use to help you get to the bottom of this question.

For starters, you should know how much money you get in every paycheck. The next step is figuring out what is being taken out of it for taxes, insurance, and other deductions.

Don’t fret. We’ll figure it out together.

Take home pay is the money we receive from our employer after they have taken out taxes and other deductions. This amount is what we get to keep and use for our own spending. Take Home pay is the amount of what you make that actually goes into your pocket. This the number you must refer to when building out a USEFUL budget.

If you aren’t immediately sure how much goes into your paycheck, visit your employer’s HR and Payroll programs. Lots of companies use software like Workday or ADP.

Then, take a careful look at how much is going into taxes and other deductions. The deductions may include health or life insurance, 401k, or RSUs.

To help you calculate how much of your wages go into taxes, use this calculator below. Once you’re finished, write down your numbers before moving onto build a budget.

Best Apps to Track Your Spending

.jpeg)

You need A budget (YNAB)

Best for user friendliness and financial education:

Once you sign up, you can easily create your first budget and allocate every dollar for a specific purpose, such as your rent or car payment. The goal is to value every dollar enough that it can help you get at least one month ahead financially— aka Zero Based Budgeting. YNAB aims to teach its users financial literacy enough by providing learning resources to help you stay on track. For $99/year, this option is quite costly but considerably worth it!

PocketGuard

Best for overspenders:

PocketGuard aims to help people easily understand how much money can be spent within their budget each month. Their In My Pocket feature is designed to help users keep tabs on their spending money after paying for bills & necessities. This option is great for those using the 50/30/20 Budgeting Method. Additionally, it can also track your spending by retailer and negotiate bills if needed.

Zeta

Best budgeting app for couples (all relationship stages):

Zeta is a free budgeting app designed specifically for couples, whether they share joint finances or not. The app caters to all types of couples — including those who are co-living, married, or new parents. You can sync various accounts to track spending, see your net worth, and manage bills together. You can also sign up for a joint no-fee banking account and cards with features like no account fees, digital checks, and access to the Allpoint ATM network.

Empower

Best app for building wealth:

Unlike the other apps, Empower is a wealth management app that helps you track your portfolio and spending habits. Unfortunately, it doesn’t allow you to set specific budget goals. However, it can help you get a better picture of your investment portfolio. They have tools for retirement planning, investment fee analysis, and networth planning. Empower is free to use, with the option to add investment management services. However, Your Rich BFF doesn’t recommend it because the fees tend to be quite high.

Your Rich BFF’s Budgeting Excel Sheet

Build a budget.

Now that you’ve gone through all of the motions of figuring out how much you make and your budgeting style. To help you get started, I’m sharing a brand spankin’ new version of of my personal budgeting spreadsheet.

Remember that everyone’s budget will look relatively different, so use this file as a template to help you start a budget of your own.

The Best Online Banks in 2024

If you're looking for top-notch financial services and peace of mind, these banks have got you covered. We've curated a selection of our favorite online-only banks that offer a range of features to meet your needs. Whether you're interested in robust online banking platforms, competitive interest rates, or convenient mobile apps, you'll find it all here.

Why choose an online-only bank? Firstly, these banks operate solely online, meaning they have lower overhead costs than traditional brick-and-mortar banks. This often translates to better interest rates, lower fees, and more competitive loan options for their customers. Secondly, online-only banks are known for their user-friendly interfaces and intuitive mobile apps, making banking on-the-go a breeze. Lastly, these banks are fully chartered, ensuring rigorous regulatory standards protect your deposits.

Check out SoFi Bank

Check out SoFi Bank- Large, free, nationwide ATM network with no fees

- No account fees, maintenance, or overdraft fees.

- Est. Earnings can be up to $1,150 in one year

- Best for: Those who want to earn high interest and don’t mind using customer service online or by phone instead of at bank branches

Check out Marcus by Goldman Sachs

Check out Marcus by Goldman Sachs- Up to 4.40% APY with $0 balance min

- One of the more competitive rates with few fees

- No fees for wire transfers, monthly maintenance or overdraft

- Best for customers who want to earn competitive savings rates because it rewards savers with higher-than-average rates.

check out American Express savings

check out American Express savings- Est. Earnings $1,075 over 1 year of membership

- 24/7 Customer Service, Low Min Deposit, no monthly fees

- Est. Earnings can be up to $1,150 in one year

- Best for: AmEx Credit card holders who’d prefer a one stop shop to manage all investments and online savings, checkings, and certificate of deposite accounts.

Check out Ally Bank

Check out Ally Bank- No overdraft fees, out-of-network ATM fees, or monthly fees

- Allows 10 certain transfers and withdrawals from your Ally Bank savings account per your statement cycle (some limits apply)

- Best for: those who are comfortable with online-only banking yet want access to loans. The account is online only and doesn't include an ATM card, you’ll have to do an online/phone/wire transfer or request a check to access your funds.

Your Rich BFF's Debt Pay Back Simulator

Feeling down bad about debt? Well don’t let it keep you down.

Debt is a normal part of most people's financial journey. The truth is that all types of people have debt— both the rich and the poor. However, sometimes when regular, average people borrow money - it can be demonized as a "bad thing".

I'm here to tell you you shouldn't feel embarrassed about having debt, BUT if you have debt and want to pay it down, I can help with that too!

The first step to managing your debt is putting it all on the table with a debt paydown simulator like the one I’ve made for you HERE! Use this debt paydown simulator to get a sense of what debt paydown strategy may work best for you. Try to look at it with a neutral lense, use kind words with yourself, and keep a positive attitude about your ability to tackle it! Once you have an idea of what strategy aligns with your personality, you'll be able to make a plan to crush your debt!

Quiz: Which Brokerage Should I Use?

Directions: For each question, choose the option that best describes your attitude towards money and budgeting. Record your answers and find out what method suits you best at the end!

- How would you best describe your technology usage in regards to investing?

A) I mostly plan on investing on my desktop computer

B) I mostly plan on investing on my mobile phone

C) I want to utilize a blend of both my computer and my phone - Choose the option that most accurate describes your current comfort level with choosing investments:

A) Very comfortable selecting investments on my own.

B) Pretty new to selecting investments, but I think I can figure it out with a little guidance.

C) like I have no idea what I'm doing, and just wish someone would do this for me. - Choose the option that most accurate describes how involved you’d want to be in your investments:

A) Be super involved in my investing.

B) Be sort of involved in my investing.

C) Spend as little time as possible while still investing. - What do you mostly plan on investing in?

A) Stocks, Bonds, ETFs, and Mutual Funds

B) Stocks and ETFS

C) I don’t know what these words even mean

Mostly A’s— Traditional Brokerages:

You should consider a traditional brokerage! Fidelity, Vanguard, or Schwab are some options.

You seem to be very confident in your own ability to select investments, and these options will give you the widest range of research and information to dive into. While all three of these platforms have apps, they are likely a bit clunkier, so you'll likely want to opt for buying/selling/researching your investments via a desktop computer. DIYing your investments means you will pay the fewest in fees, but likely spend the most time!

Mostly B’s— Modern Brokerages:

You should consider a more modern brokerage! Webull, Public, and Robinhood are some options.

You have a decent understanding on how to select investments, but want to keep things simple and do most of your investing via your phone. These platforms can be great for beginners as they all offer mobile apps and fractional investing (aka you can get started for as little as $1). DIYing your investments means you will pay the fewest in fees, but likely spend more time! That said, one watch out is that often, these modern brokerages can make investing a little.... too fun. I encourage you to make sure you're still sticking to the investing fundamentals and not diving into risky behaviors like day trading.

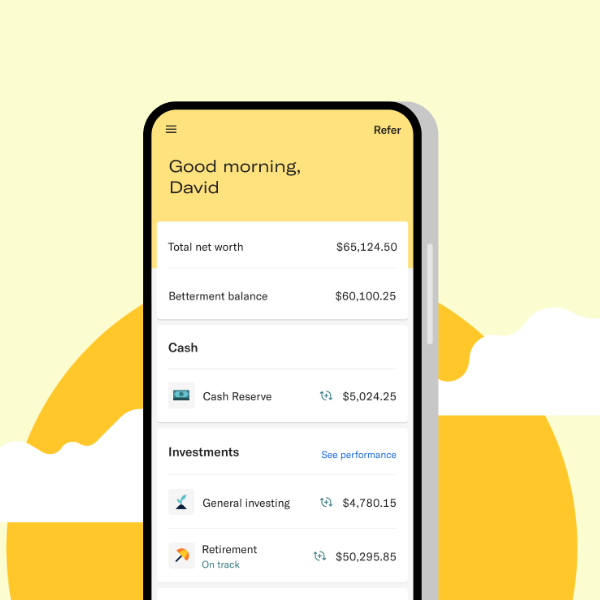

Mostly C’s— Robo Advisor :

You should consider a Roboadvisor! SoFi, Wealthfront, and Betterment are some options.

You recognize that investing is an important part of your financial future, but the less time you can spend doing it, the better. You'll take a quick quiz about your money goals - things like how much you make, your age, when you want to retire, your plans for the future, etc and one of these little roboadvisors will put together an investment portfolio that suits your needs! These platforms all have strong websites for desktop, as well as apps for your mobile phone, and you likely won't have to spend a lot of time researching on your own. While you will pay a small management fee to avoid the trouble of DIYing your investments, it'll still be meaningfully less than investing your money with a human financial advisor, and you'll skip the analysis paralysis so you can get investing sooner rather than later!

The Best Robo-Advisors

What is it? Robo-advisors are virtual financial planners that uses smart computer programs. Think of it as having a financial advisor in your pocket that works 24/7, using algorithms to help you grow your money over time. It's a convenient and cost-effective way to start investing without the need for a lot of financial know-how.

How it works: A robo-advisor automatically manages your investments. You provide information about your financial goals, how much risk you're comfortable with, and how long you plan to invest. The robo-advisor then uses this info to create and manage a diversified investment portfolio for you.

The investment choices are based on things such as:

- How much risk you’re willing to bear

- What level of returns you want

- When you need the money

- Based on these factors, robo-advisors frequently pick Exchange Traded Funds (ETFs).

Benefits of a Robo-Advisor:

- Lower Cost: Unlike traditional financial advisors who may charge high fees for their services, robo-advisors often have lower fees. This is because they use algorithms to do a lot of the work, reducing the need for human intervention.

- Hands-Off Approach: Setting up an account with a robo-advisor is usually straightforward. Once you've set things up, the robo-advisor takes care of the day-to-day management of your investments. This includes things like buying and selling assets to keep your portfolio in line with your goals.

- Accessible: Since robo-advisors operate online, you can check your investments and make decisions from anywhere with an internet connection. It's a more accessible way to get into investing, especially for younger individuals who might be more comfortable with digital platforms.

- Regular Maintenance: Your financial situation may change over time. Maybe you get a raise, or your goals shift. Robo-advisors often monitor your portfolio regularly and make adjustments as needed to keep things on track.

Check out SoFi

Check out SoFi- SoFi’s robo-advisor takes the stress out of investing by helping you with the hard part: investment planning, rebalancing, diversification, and recurring deposits.

- Automated investing with SoFi gets you access to member benefits like career services, rate discounts on other SoFi products, and exclusive events.

- No advisory fees as of Dec 26, 2023. You can make recurring or one-time investments, starting as low as $1

Check Out Wealthfront

Check Out Wealthfront- Just answer a few questions, and they’ll build you a personalized portfolio of low-cost index funds from up to 17 global asset classes.

- Their software handles trading, rebalances, diversify deposits, and tax-loss harvesting automatically

- Also offers Socially Responsible portfolios

- 0.25% investment management fee

Check Out Betterment

Check Out Betterment- Betterment is built to help you achieve what you want with your money.

- Invest with an automated, expert-built portfolio

- For just $4 a month or 0.25% annually, you get all the benefits of automated investing: expert-built portfolios, ongoing guidance, and tax-efficient strategies at just a fraction of the cost of a traditional advisor.

Your Rich BFF's Investing Cheat Sheet

Learn to invest so good, It Feels Like Cheating.

Remember that feeling when your smart friend gives you a cheat sheet for that college exam? Well, here ya go. Vivian has put together a three page Investing 101 cheat sheet for allll the besties looking to get Rich AF.

What credit card should you get?

Your Rich BFF's Advice on Credit Cards

🚫 RICH PEOPLE DON’T GET CARDS JUST BECAUSE THEY LOOK COOL. One common credit card mistake is signing up for something that doesn't suit your needs or spending level. Rich people don’t sign up for cards just for the status symbols— They pick based on what cards actually work for them and their lifestyle. Then return to this post to get the actual rundown of how these credit cards stack up in reality.

✅ RICH PEOPLE DO GET THE CARD THAT SUITS THEIR GOALS. Your Rich BFF recommends taking Smart Asset’s Quiz to Find the Right Credit Card For You. This quiz will help you recognize what things you want and care about regarding credit cards. Return to this page once you’re done to get the real rundown. The only way to successfully game the credit card system is by only spending what you can afford. Think critically about how you spend (everyday vs. travel), your income (consider annual fees & APRs), and what you want to establish (build credit vs. accrue debt).

Your Rich BFF’s Favorite Credit Cards

Vivian’s Wallet: Which Credit Cards I Have

- Recommended Credit Score: Average 650 - Excellent 850

- Rewards: Unlimited 2% cashback on all purchases. For every dollar that you spend on this card, you can earn 1% of it back. On top of that, you can earn an extra 1% for every dollar you pay off. The cashback potential is unlimited. Plus, enjoy a 0% APR on Balance Transfers for the first 18 months of opening a credit card! 👀

- Annual Fee: $0

- APR: 19.24%-29.24% variable APR.

- Why I have this: I consider this card my everyday cash-back card because I know I’ll earn a ‘lil something on anything I spend it on. It rewards you for only spending what you can afford— which I’ve learned that this is the best practice to help you maintain healthy credit & debt ratios.

- Cons: This is more of a beginner card to incentivize good spending & paying off your balance. However, this credit card only offers cash back as its primary reward type.

- Recommended Credit Score: Average 650 - Excellent 850

- Rewards: Earn 3x dining & drug stores and 5x on Lyfts. Points can be redeemable for cash back AND travel (through Chase Travel) which makes it a great starter card to pool up points.

- Annual Fee: $0

- APR: 20.49% - 29.24%% variable APR

- Why I like this: I got this card in college because it offers fraud protection, travel insurance, and emergency assistance. It’s great when coupled with the other Chase cards because it helps you collect reward points faster.

- Cons: Introductory travel card so you still have to deal with foreign transaction fees :(

- Recommended Credit Score: Average 650 - Excellent 850

- Rewards: Get up to 10x on travel booked through Chase & 3x on all other purchases.

- Annual Fee: $550

- APR: 22.49% - 29.49% variable APR

- Why I like this: This card offers luxurious perks such as airport lounge access and credits towards Global Entry, TSA Pre-Check and NEXUS. Additionally, you can enjoy member benefits through their partnerships with Instacart, Doordash, Lyft, and many others.

- Cons: This is one of the more premium cards that Chase offers — there are cards such as the Sapphire Preferred (covered below) which comes with a lower fee. It comes with a hefty $550 annual fee, but it easily pays off by offering over $1200 in partnership reward value.

- Recommended Credit Score: Average 650 - Excellent 850. Great for credit building! No hard pulls.

- Rewards: You can pick your reward categories based on what your spending! Tweeak it twice a year.

- APR: 22.49% - 29.49% variable APR

- Why I like this: It’s great for business and personal use because there are no fees and great rewards. I got this card because it specifically benefits those who are self-employed and working in digital content creation such as camera equipment, merchandising, ad spending, more. It allows for flexible spending limits & easy business expensing.

- Cons: It most highly benefits people who are in content creation & digital media.

- Recommended Credit Score: Good 690 - Excellent 850

- Rewards: 5X points on up to $500,000 per calendar year spent on directly booked airfare, flights and prepaid hotels through American Express Travel. Earn 1x on every dollar spent.

- Annual Fee: $695 — the most expensive one here.

- APR: 21.24% - 29.24% variable APR

- Why I like this: Though it has a big annual fee, monthly credits and perks may outweigh the price tag. It comes with tons of luxury perks for traveling, eating out, and shopping. You will have access to the Amex Centurion Lounge at worldwide airports. As an AMEX member, you could also benefit advance concert and event tickets, plus lounges at stadiums and festivals across the country.

- Cons: The $695 fee is a hard pill to swallow for anyone, but the perks are worth $1,500 in value. Plus, you can earn up to 150,000 points if you reach the introductory spending offer.

Other Cards that I Recommend:

- Recommended for those who are building credit

- Req. Credit Score: No minimum score required. Average holders are around 300-690.

- Rewards: Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- APR: 28.24% Variable APR

- Pros: This is an amazing option for people who are looking to build credit. You’ll be able to get cash back. Discover will automatically review your account within 7 months to see if they can help transition you onto cards with better rates and rewards.

- Cons: This card requires a minimum security deposit and has a higher APR rate than other cards.

- Recommended Credit Score: Good 690 - Excellent 850

- Rewards: Earn up to 60,000 points in your intro offer. Earn 5x rewards when booking travel,

3x for restaurants (food delivery included). 2x on other travel purchases. - APR: 21.49%–28.49% variable APR

- Pros: This is my recommendation if you want to start working your way into racking up travel points, but don’t want to deal a huge annual fee. There are TONS of resources to teach you how to maximize the rewards. You get all of the member benefits from Chase (Doordash, Instacart, Lyft credit). There are no foreign transaction fees. Plus, you can get travel insurance coverage, credit towards Global Entry/TSA Pre-Check, and more.

- Cons: There is a $95 annual fee, but no lounge access. This is good for people just starting to venture into credit cards to gain travel perks and member fees.

- Recommended Credit Score: Good 690 - Excellent 850. Recommended for dining perks.

- Rewards: Recommended for dining perks. Earn up to 60,000 points in your intro offer. Earn 5x rewards when booking travel, 3x for dining (food delivery included) and 2x on other travel purchases.

- Annual Fee: $250 per year

- APR: 21.24% to 29.24% variable APR.

- Pros: The Amex Gold comes with benefits such as dining reservation and exclusive member events around major cities in the US. It also features other perks, such as baggage insurance, no foreign transaction fees and access to The Hotel Collection by American Express. You’ll also get $120 Uber credits, which can be used for either Uber rides or Uber Eats

- Cons: Unlike the Amex Platinum, carrying this card does not allow you into airport lounges. I recommend considering your highest-spend purchase categories, credit score, travel plans, and existing credit cards before opening this card. Knowing how to use AmEx points is also important and can greatly affect how you benefit from this card.

- Recommended Credit Score: Excellent Credit 720 - Excellent 850

- Rewards: Earn 2x for every dollar spent. When you book travel with Capital One, you can earn up to 5x miles and 10x miles on hotels & car rentals.

- APR: 19.99% - 29.99% Variable APR

- Annual Fee $395

- Pros: The Capital One Venture X Rewards Credit Card has an excellent rewards rate, access to airport lounges and hundreds of dollars worth of travel credits that can make up for the fee. High reward rates and flexible redemption rules. No foreign transaction fees. Unlimited complimentary airport lounge access for you and two guests to 1,300+ lounges.

- Cons: Capital One lacks a major U.S. carrier as a travel partner. It may be pricey for those who do not travel frequently. The best way to maximize these rewards is booking travel through Capital One.

Other Cards that are good for Business Expenses:

- American Express Platinum for Business: Like the Amex Platinum Card, the Business card offers a lot of similar premium benefits. The Business Platinum bonus is worth more at $2,400 because it comes with a steeper $15k intro bonus spend. You get exclusive business-related perks for Indeed, Adobe, Dell, and other business expenses.

- American Express Blue Business Cash™ Card: For $0 Annual Fees, you can use this card to help you earn cashback for all of your spending. It goes great with other Business Amex cards. Earn up to 3% for purchases. It has a lower APR, but does not allow team member cards.

- American Express Business Green Rewards Card: For a $95 fee, this Amex card is a step up from the Blue Business Card. The earning rates and benefits will be most attractive to young professionals and millennials who travel for work, pleasure, or both. The card earns 3 Membership Rewards points per dollar on travel, restaurants, and transit, so you'll want to consider this card if a large chunk of your budget goes toward these categories. You can get cards for other team members.

The BEST Free Tax Filing Software

Did you know?

The IRS offers a convenient and user-friendly solution to help individuals and business owners electronically file their taxes. The service is available January to April each year, however feel free to poke around to get the information you need.

Vivian's Best Money Hacks

401k Rollover

Use this took to help find any money from your old 401ks to ensure you see all the money!

Cashback

Using cashback tools is one of the easiest ways to get money back on items you were already going to purchase. Using Rakuten allows you to get cashback at 3500 different retailers!

college Major Finder

Interested in finding out which majors get paid the most? Want to look out for your expected salary post-graduation? Look at THIS ARTICLE from the Wall Street Journal to find out which majors have the most debt.

Salary By Profession

U tool to help determine your expected salary depending on varying professions. A must-use for all students!

Spoken.io

Want designer furniture at a cheaper price? Spoken.io allows you to find the same designer items at the cheapest price across all known sellers. Don’t get stuck paying a name-brand price for the same item!

Ibotta App

What’s even better than cashback? Cashback on groceries. Use the Ibotta App to get cashback on your grocery purchases either in store or online.

Dollar For

Medical debt can be one of the most debilitating things Americans deal with. Luckily, Dollar For can help consolidate and give you relief from medical debt.

Tinywow

Don’t overpay with subscription-based digital resources! Use to get tools like a pdf converter, background remover and so much more!

VAT Refund

The VAT (value added tax) is a 5% - 25% percent tax that’s already included in the price of many designer goods purchased abroad. If you’re a foreign tourist, some or all of this tax can be refunded back to you.

Discounted Medication

Cost Plus Drugs, launched by Mark Cuban, is helping consumers avoid high drug prices by charging manufacturers' prices plus a flat 15% markup plus pharmacist fee. In an industry where 500-1000% markups aren’t uncommon, 15% feels really fair.

Missing Money

Every year states receive lost and unclaimed money from stuff like uncashed checks, insurance policies, security deposits, etc. And if you don’t go and hunt for it - the government has no way of getting it back to you. MISSINGMONEY.COM is a website that lets you search if there’s any money owed to you.

Scholarship Finder

SCHOLARSHIPS.COM is a database of 3.7 million scholarships worth roughly $19 billion in financial aid. The site lets you filter scholarships by things like major, ethnicity, state, sports, etc. You can search the website’s directory without a profile, but you’ll need to create one to find out if you qualify.

Flight Discounts For Students

You can use KAYAK.COM/C/STUDENT or STUDENT UNIVERSE to get discounted flights as a student.

Get Your Tampon Tax Back

Shoppers who purchase products from any of these brands, in stores or online, can now submit their receipt to TAMPONTAXBACK.COM and be reimbursed the sales tax on their purchases. All you have to do is show them a picture of your receipt and within 24 hours they’ll Venmo or PayPal you back the tampon tax you paid!

Plus Size Travelers: Get a Second Seat For Free

Through Southwest Airlines Customers of Size policy, if you are plus size and require two seats on an airplane, you can actually get the second one for free! You have to book two seats upfront, but you can get the second one refunded

Seated

Get cashback on dining in the form of discounts with the SEATED APP! The app basically pays you money to eat out. It’s almost too good to be true.

.png)

.png)